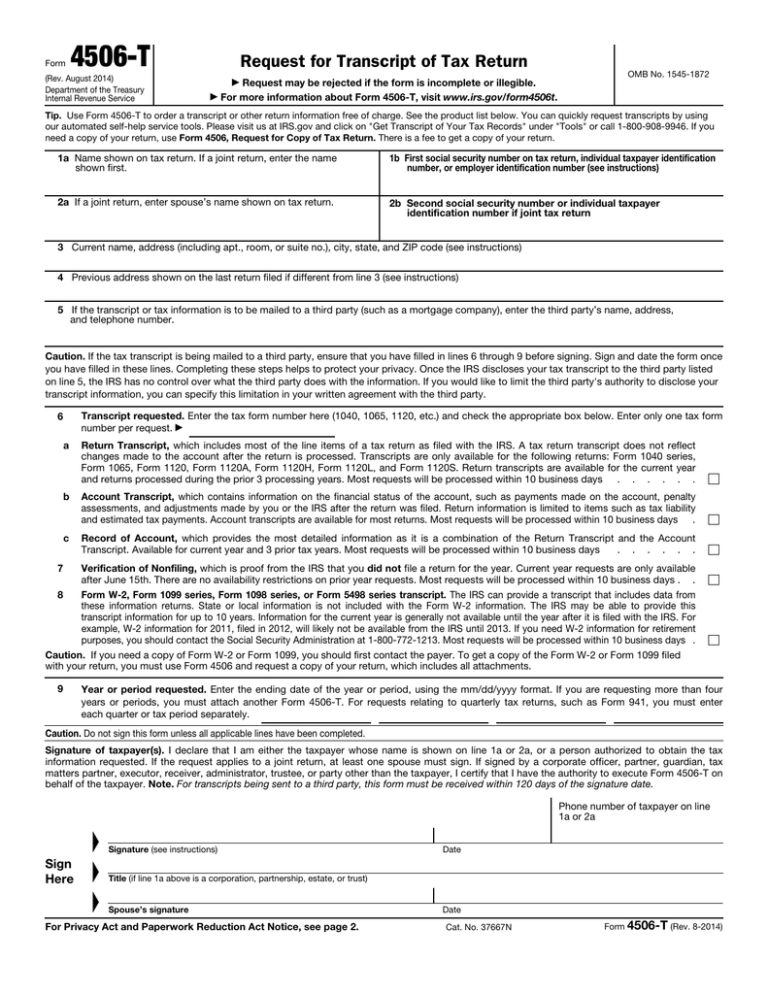

If a taxpayer has moved since they last filed a tax return with the IRS, they need to first submit Form 8822, Change of Address, to ensure that the transcript is mailed to the correct address. It does not need to be a “certified” copy as is the case with some other documents. The mailed transcript is an official document. The IRS will mail the transcript to the address of record entered on the prior year’s tax return. Businesses and individuals who need a tax account transcript should use Form 4506-T, Request for Transcript of Tax Return. To request an individual tax return transcript by mail or fax, complete Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.To order by phone, call 80 and follow the prompts.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

The fastest way to get a transcript is through the Get Transcript tool on IRS.gov. Similarly, if a taxpayer plans to apply for a loan, they should ask their financial institution if a transcript will be necessary so they can plan ahead and have it at the appropriate time. Frequently, students get all the tax return information they need on the FAFSA application via the IRS Data Retrieval Tool. If a taxpayer is returning to college this January and applying for financial aid, they should check with their financial aid department at school to see if they will need a copy of their transcript before they start classes. This includes college financial aid applicants or taxpayers who have applied for a loan to buy a home or start a business. Though taxpayers should always keep a copy of their tax return for their records, some may need the information from filed tax returns for many reasons. By planning ahead, they should receive their transcript in the mail within five to 10 days from the time the IRS receives the request online. The IRS is reminding taxpayers that the quickest way to get a copy of their tax transcript is to order it online using the Get Transcript application on IRS.gov.

0 kommentar(er)

0 kommentar(er)